Multiple Choice

Identify the letter of the choice that best

completes the statement or answers the question.

|

|

|

1.

|

Ms. Seller is interviewing agents to list her property. She has the following

quotes from two different companies: XYZ Realty, 7 percent commission; and Redford Realty, 5.5

percent commission. If her house sells for $225,000, how much will she save if she lists her property

with Redford Realty?

a. | $3,357 | c. | $4,500 | b. | $3,375 | d. | $5,400 |

|

|

|

2.

|

At closing, the seller paid the broker $21,000, which was equivalent to 7

percent of the selling price. What was the selling price of the property?

a. | $147,000 | c. | $300,000 | b. | $210,000 | d. | $400,000 |

|

|

|

3.

|

A sales associate for XYZ Realty listed and sold a $175,000 home. The seller

paid a 6 percent commission of which the agent received 2 percent for listing the property, and 1.5

percent for selling the property. How much was the broker's share of the commission?

a. | $10,500 | c. | $6,125 | b. | $5,250 | d. | $4,375 |

|

|

|

4.

|

A property sold for $235,000 and the selling broker's half of the

commission was $8,225.

What was the commission rate?

a. | 4 percent | c. | 6 percent | b. | 5 percent | d. | 7 percent |

|

|

|

5.

|

A broker and sales associate split commissions on a 60/40 basis. How much

commission will the sales associate earn if sells a property for $125,000, and a 6 percent commission

is paid?

a. | $7,500 | c. | $4,500 | b. | $3,000 | d. | $3,500 |

|

|

|

6.

|

When the seller listed a property, he agrees to pay a 7 percent commission. The

proper sold for $190,000. If the listing agent was paid 2 percent, and the selling agent was paid 1.5

percent, how much was the broker paid after paying his agents?

a. | $2,850 | c. | $6,650 | b. | $3,800 | d. | $13,300 |

|

|

|

7.

|

Ann listed her property with an XYZ Realty that charges a flat fee of $2,995 to

list the property. If an agent within XYZ sells the property, the total commission paid is $2,995.

However, if an agent from another company brings the buyer that purchases the property, the owner

agreed to pay that company a 3 percent commission. An agent from JFK presented an offer of $425,000.

If the offer is accepted, the total commission that the owner will pay is

a. | $15,745 | c. | $11,250 | b. | $12,750 | d. | $10,500 |

|

|

|

8.

|

A broker sold a property for $250,000. She was paid 6 percent on the first

$100,000. 5 percent on the next $100,000, and 4 percent on the balance. How much was the broker

paid?

a. | $6,000 | c. | $13,000 | b. | $5,000 | d. | $24,000 |

|

|

|

9.

|

An agent was paid $2,500, which was half of the 7 percent that the broker

collected. What was the sale price of the property?

a. | $71,248 | c. | $35,417 | b. | $35,714 | d. | $71,428 |

|

|

|

10.

|

A broker and a sales associate split commissions on a 60/40 basis. If the

broker's share of the commission was $3,500, and the sale price was $83,333, what was the

commission rate?

a. | 6 percent | c. | 7.5 percent | b. | 10.5 percent | d. | 7 percent |

|

|

|

11.

|

When the owners sold their property, they paid a 6 percent commission. Their

check after the commission was paid was $470,000. What was the selling price of the property?

a. | $500,000 | c. | $800,000 | b. | $783,333 | d. | $900,000 |

|

|

|

12.

|

An owner sold her condo and paid 6 percent commission to the selling broker. If

her net was $200,000, what was the sale price?

a. | $205,698.49 | c. | $225,349.59 | b. | $212,765.95 | d. | $229,879.39 |

|

|

|

13.

|

After closing expenses of $550 and a 6 percent commission was paid, the seller

received a check for $149,850. What was the sale price of the property?

a. | $150,400 | c. | $159,424 | b. | $155,424 | d. | $160,000 |

|

|

|

14.

|

Mr. Seller wants to net a profit of $20,000 and agrees to pay a 7 percent

commission. He also has selling expenses of $400 and a mortgage of $35,250. What is the minimum offer

he could accept for the property?

a. | $59,839 | c. | $58,565 | b. | $59,545 | d. | $59,656 |

|

|

|

15.

|

Mr. and Mrs. Seller want to net a 12 percent profit after paying the brokerage

firm a 6.5 percent commission. If the original purchase price was $104,500, what is the minimum offer

they can accept?

a. | $125,716 | c. | $125,176 | b. | $117,040 | d. | $124,647 |

|

|

|

16.

|

An apartment building with a $90,000 net operating income and an 8 percent cap

rate has a value of

a. | $1,000,000. | c. | $1,500,000. | b. | $1,125,000. | d. | $1,720,000. |

|

|

|

17.

|

An apartment building has a semiannual net income of $48,000 and has been

appraised for $1,250,000. What is the cap rate?

a. | 3.84 percent | c. | 7.68 percent | b. | 4.38 percent | d. | 7.86 percent |

|

|

|

18.

|

Last year, an apartment building had an effective gross income of $55,575 and

expenses of $5,500. If the cap rate is 10 percent, what is the value?

a. | $555,555 | c. | $500,000 | b. | $555,750 | d. | $500,750 |

|

|

|

19.

|

If the gross rent multiplier of the property is 112 and the rent is $600

monthly, what is the value of the property?

a. | $76,200 | c. | $27,600 | b. | $62,700 | d. | $67,200 |

|

|

|

20.

|

Three years ago, a buyer paid $150,000 for a three-bedroom home. The property

has appreciated at 5 percent each year. What is the value of the property today?

a. | $172,500 | c. | $175,464 | b. | $173,644 | d. | $179,300 |

|

|

|

21.

|

Two years ago, a buyer paid $175,000 for a house. Since that time, the property

has depreciated 3 percent each year. What is the value of the property today?

a. | $164,500 | c. | $185,500 | b. | $164,658 | d. | $185,657 |

|

|

|

22.

|

The replacement cost of a building is $250,000. It has an annual depreciation of

8 percent, a site value of $50,000, and annual taxes of $3,950. What is the value of the

property?

a. | $230,000 | c. | $280,000 | b. | $276,050 | d. | $283,950 |

|

|

|

23.

|

A building has a semiannual effective gross income of $250,000. If the annual

expenses are 20 percent of the effective gross income, what is the net operating income?

a. | $500,000 | c. | $100,000 | b. | $200,000 | d. | $400,000 |

|

|

|

24.

|

Three years ago, the owner paid $165,000 for her property. During her period of

ownership, she added a family room valued at $16,500 and $10,000 worth of other improvements. If she

sells the property for $240,000 and pays a 7 percent commission, what capital gains may she

exclude?

a. | $25,300 | c. | $37,100 | b. | $31,700 | d. | $48,500 |

|

|

|

25.

|

A property was purchased for $250,000. The owner added a tennis court at

a cost of $10,000. Two years later, the property sold for $325,000 and the seller paid a 7 percent

commission plus $250 in attorney fees. If he purchases another property for $350,000, how much

capital gains will he exclude?

a. | $22,750 | c. | $42,250 | b. | $42,000 | d. | $42,520 |

|

|

|

26.

|

The rent collected in a 12-unit building is as follows: three apartments, $550;

three apartments, $600; and three apartments, $650. There is a vacancy rate of 4 percent, an

additional annual income of $2,400, and annual expenses of $5,000. With a cap rate of 9 percent, how

much should the buyer pay for this property?

a. | $661,244 | c. | $717,866 | b. | $698,534 | d. | $773,422 |

|

|

|

27.

|

Five apartments rent for $550 per month, and five others for $600 per month.

There is an 8 percent vacancy rate and monthly expenses of $250. If a buyer wants to yield an 8

percent return, what should he pay for the property?

a. | $790,375 | c. | $756,000 | b. | $765,000 | d. | $790,735 |

|

|

|

28.

|

A property is now worth $117,978. If it has appreciated 6 percent each year for

the past two years, what was the original investment?

a. | $111,300 | c. | $104,245 | b. | $105,000 | d. | $110,899 |

|

|

|

29.

|

A property is now worth $98,250. If it has depreciated in value 5 percent each

year for the past two years, what was the original investment?

a. | $103,421 | c. | $108,864 | b. | $103,241 | d. | $108,320 |

|

|

|

30.

|

A property appraised for $125,000. If the assessment rate is 100 percent and the

tax rate is $1 per $100, what are the annual property taxes?

a. | $1,250 | c. | $1,350 | b. | $1,520 | d. | $1,550 |

|

|

|

31.

|

If the market value of a property is $ 169,000, it is assessed at 35 percent,

and the tax rate is $4.25 per $100, what are the monthly property taxes?

a. | $2,513.88 | c. | $409.49 | b. | $2,531.88 | d. | $209.49 |

|

|

|

32.

|

The appraised value of a property is $52,350. It is assessed at 38 percent of

the appraised value, and the tax rate is 95 mills. What are the quarterly property taxes?

a. | $472.45 | c. | $1,998.83 | b. | $1,889.83 | d. | $1,589.83 |

|

|

|

33.

|

The market value of a property is $65,000 and is assessed for 45 percent of its

value. If the owner's semiannual tax bill was $511.88, what was the tax rate per $100?

a. | $3.50 | c. | $1.75 | b. | 350 mills | d. | 175 mills |

|

|

|

34.

|

The owners received a semiannual tax bill of $984.38. Property in the

jurisdiction is assessed at one-fourth the market value. If the tax rate is $4.50 per $100, what is

the estimated market value of the property?

a. | $43,750 | c. | $195,000 | b. | $175,000 | d. | $53,750 |

|

|

|

35.

|

A person purchased a new home, and her one-year insurance policy began on

September 14, 2005, with a premium cost of $504. Her company transferred her, and when she sold her

house, the buyer assumed her policy at the closing on January 25, 2006. How much will be credited to

the buyer on the closing statement?

a. | $183.40 | c. | $320.60 | b. | $138.40 | d. | $319.20 |

|

|

|

36.

|

The lender required the buyer to insure 100 percent of the value of

improvements. The appraiser determined her property value, including the site, to be $335,000. The

site was 20 percent of the value. The buyer purchased a two-year insurance premium that began on the

closing date of November 15, 2006. The premium was $879. Her company transferred her July 11, 2007,

and the buyer assumed her policy. Which of the following will be entered on the HUD-1

statement?

a. | $288.13 CS, DB | c. | $589.26 CS, DB | b. | $288.13 DB, CS | d. | $590.87 DB, CS |

|

|

|

37.

|

On January 1, the seller paid the $2,345 in taxes for the current year. If he

sold the property on June 23 of that same year, how much would he be credited at closing?

(Use a

360-day year.)

a. | $1,158.78 | c. | $1,293.53 | b. | $1,218.10 | d. | $1,772.50 |

|

|

|

38.

|

The owners live in a county where taxes are paid in arrears and 360 days are

used to compute the property tax bill. The house closed on April 13. If the annual tax bill is

$3,355, how much will be credited the buyer on the settlement statement for taxes for this

year?

a. | $946.57 | c. | $2,407.78 | b. | $959.96 | d. | $2,441.84 |

|

|

|

39.

|

Semiannual property taxes of $450 were paid only for the first half of the year.

The property sold on July 11 and closed on September 19. If the taxes were prorated between the buyer

and seller as of the date of sale, which of the following is TRUE?

a. | $252.50 CS, DB | c. | $27.50 DS, CB | b. | $252.50 DS, CB | d. | $497.50 CS, DB |

|

|

|

40.

|

A buyer negotiated a $75,000 loan at 8 percent interest for 30 years, with the

first payment due in arrears on April 1. If the closing takes place on February 26, how much interest

must the buyer pay on the day of closing?

a. | $566.78 | c. | $56.68 | b. | $656.78 | d. | $66.68 |

|

|

|

41.

|

A buyer offer of $295,000 was accepted, and a loan was negotiated for 80 percent

at 7 percent for 25 years. The closing took place on January 5, and the buyer's first PITI

payment is due March 1. Using a 365-day year, how much interest would the buyer be debited on the

closing statement?

a. | $226.30 | c. | $1,276.67 | b. | $1,176.76 | d. | $1,652.00 |

|

|

|

42.

|

The buyer assumed a loan of $50,000 at 8.25 percent interest. Payments are due

on the first of the month, in arrears. The last payment was made on April 1, and the closing took

place on April 20. Which of the following is TRUE?

a. | $119.60 CS, DB | c. | $229.20 CS,DB | b. | $119.60 DB, CS | d. | $229.20 DS, CB |

|

|

|

43.

|

The buyer had a 20 percent down payment on a property she purchased for $89,500.

She also must pay a 1 percent origination fee, $350 for title insurance, and one discount

point.

How much money will the buyer owe at the closing?

a. | $18,966 | c. | $17,423 | b. | $19,682 | d. | $20,350 |

|

|

|

44.

|

After the borrower made his payment on September 1, his loan balance was

$12,259.

His monthly payment is $124.34 per month paid in arrears on the first of the month.

The

interest rate on the loan is 9 percent. On October 1, he paid the lender for the October

1

payment, then paid off the entire mortgage balance. If the prepayment penalty was 2

percent, his

prepayment penalty charge was approximately

a. | $244.53. | c. | $232.40. | b. | $245.18. | d. | $247.93. |

|

|

|

45.

|

A property was purchased for $175,000. If the loan was $131,250, what was the

loan-to-value ratio?

a. | 90 percent | c. | 75 percent | b. | 80 percent | d. | 70 percent |

|

|

|

46.

|

A lender negotiated an $82,250 loan, which was 80 percent of the appraised

value. The appraised value of the property is

a. | $65,800.50 | c. | $82,250.50 | b. | $68,500.50 | d. | $102,812.50 |

|

|

|

47.

|

The buyers applied for a VA loan to purchase a property for $79,500. The

property

appraised at $79,000. They agreed to pay a percent loan origination fee. How much

did

they pay in origination fees?

|

|

|

48.

|

A lender agreed to a 90 percent loan-to-value ratio with an interest rate of 7

percent. If the annual interest is $17,640, what was the loan amount?

a. | $176,400 | c. | $280,000 | b. | $252,000 | d. | $290,000 |

|

|

|

49.

|

The semiannual interest paid on a loan was $4,387.50. If the interest rate is

6.5 percent,

what was the loan amount?

a. | $67,500 | c. | $270,000 | b. | $135,000 | d. | $540,000 |

|

|

|

50.

|

A loan officer is paid 45 percent of the origination fee that her company

charges. The loan officer negotiated a reverse mortgage, and her company was paid 2 percent of the

appraised value of $190,000. How much was the loan officer paid?

a. | $1,710 | c. | $5,200 | b. | $3,800 | d. | $6,400 |

|

|

|

51.

|

What is the rate of interest if the mortgagor makes quarterly interest payments

of

$1,340.63 on a $65,000 loan?

a. | 2.06 percent | c. | 7.75 percent | b. | 8.25 percent | d. | 9.25 percent |

|

|

|

52.

|

To secure a $100,000 loan, the buyer paid $3,000 in discount points, and the

seller paid $2,000 in discount points. How many points were charged?

|

|

|

53.

|

A savings and loan agreed to make a $65,000 mortgage at 8 percent interest for

30 years and charged three points to negotiate the loan. What was the effective yield to the

lender?

a. | 8.375 percent | c. | 8.25 percent | b. | 8.735 percent | d. | 8.35 percent |

|

|

|

54.

|

The lender negotiated a $55,000 loan and charged three discount points. What was

the

cash outflow of the lender?

a. | $56,560 | c. | $53,530 | b. | $56,650 | d. | $53,350 |

|

|

|

55.

|

One lender charges 6.5 percent interest and the second lender charges 7 percent.

How

much money will the borrower save the first year on a $150,000 loan if he goes with the first

lender?

|

|

|

56.

|

The buyers secured an $82,000 loan at 9.25 percent interest for 30 years. Their

monthly

payment is $674.59. How much of their first payment will be applied to the

principal

balance?

a. | $42.51 | c. | $632.08 | b. | $64.51 | d. | $785.55 |

|

|

|

57.

|

The listing price of a property was $135,000. The buyer made an offer of 90

percent of

the listing price, which was accepted by the sellers. The property appraised for

$135,000, and the buyers secured an 85 percent loan at 9 percent interest for 30 years. How much

interest will be paid in the first payment?

a. | $774.56 | c. | $860.62 | b. | $747.56 | d. | $839.24 |

|

|

|

58.

|

This month's interest payment is $585.70. If the buyer secured a 90 percent

loan at an 8.75 percent annual rate of interest, what was the sale price?

a. | $80,325 | c. | $89,250 | b. | $80,235 | d. | $89,500 |

|

|

|

59.

|

A borrower secured an $80,000 loan at 8.25 percent interest, and the

lender's cash outflow was $77,600. What was the effective yield to the lender?

a. | 8.50 percent. | c. | 8.375 percent. | b. | 8.625 percent. | d. | 8.85 percent. |

|

|

|

60.

|

If a circular property has a diameter of 50' and costs $120 per square

foot, what is the cost of the property?

a. | $235,620 | c. | $1,235,620 | b. | $942,480 | d. | $2,356,200 |

|

|

|

61.

|

The N 1/2 of the SW1/4 of the NE1/4 sold for $2,500 per acre. What was the

selling price?

a. | $10,000 | c. | $40,000 | b. | $20,000 | d. | $50,000 |

|

|

|

62.

|

A lot contains 9/10 of an acre. What is the depth of the lot if the front

measures 150'?

a. | 216.36' | c. | 322.67' | b. | 261.36' | d. | 323.67' |

|

|

|

63.

|

A two-story house measures 25' x 50'. A one-story family room was

added that measures 20' x 20'. At a cost of $9.95 per square yard for carpet and $2.50 per

square yard for installation, how much will it cost to carpet the house and family room?

a. | $2,282.50 | b. | $36,105.00 | c. | $20,542.50 | d. | $4,011.67 |

|

|

|

64.

|

The rooms in Sandy's house measure as follows: living room, 20' x

25'; dining room, 18' x 20'; bedroom, 14' x 26'; bedroom, 15' x

15'; bedroom, 12' x 14'. The carpet she has selected costs $9.95 per square yard. How

much will it cost to carpet the entire house?

a. | $732.39 | c. | $950.77 | b. | $836.91 | d. | $1,787.68 |

|

|

|

65.

|

A rectangular lot measures 200' x 300'. Property in the area is

selling for $150,000

per acre. If the broker charges 8 percent, how much is she paid?

a. | $16,529 | c. | $16,730 | b. | $15,290 | d. | $19,243 |

|

|

|

66.

|

A building measures 30' x 80' x 15'. A buyer made an offer of $35

per square foot on the property. The owner made a counteroffer of $2.75 per cubic foot. How much more

will it cost the buyer if he accepts the counteroffer?

a. | $18,000. | c. | $17,000 | b. | $15,000 | d. | $16,000 |

|

|

|

67.

|

A buyer purchased a property that is one-mile square and another that measures

511.23'

x 511.23'. At a cost of $2,000 an acre, how much did she pay for the

property?

a. | $1,291,999 | c. | $1,733,435 | b. | $1,921,999 | d. | $1,373,435 |

|

|

|

68.

|

How many cubic yards of concrete must a builder buy to pour a sidewalk that

measures 45' x 3.25' and is five inches thick?

a. | 60.9375 | c. | 0.4167 | b. | 2.2571 | d. | 6.7708 |

|

|

|

69.

|

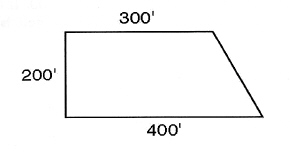

Using the dimensions in the following diagram, what is the approximate cost to

purchase at $4,000 per acre?  a. | $3,214 | c. | $9,213 | b. | $6,428 | d. | $12,856 |

|

|

|

70.

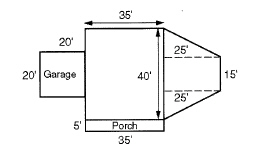

|

How many square feet of living area are there in the following house?  a. | 2,087.5 | c. | 2,775.0 | b. | 2,150.0 | d. | 2,990.5 |

|

|

|

71.

|

A tenant pays a rental of $ 15.50 per square foot annually for her office, which

measures 25' x 50'. If the leasing agent is paid 7 percent of her rent collected, how much

is she paid?

a. | $19,375 | c. | $3,345 | b. | $14,233 | d. | $1,356 |

|

|

|

72.

|

A space leases for $ 1,200 per month. The owner pays a property manager 8

percent of the gross income as commission. How much does the owner pay annually?

a. | $1,512 | c. | $1,215 | b. | $1,152 | d. | $96 |

|

|

|

73.

|

A property manager negotiated a 15-year graduated lease with the following

terms: The

lessee will pay $550 per month for the first five years, with a $50 a month increase

every five years thereafter. If the property manager is paid a 6.75 percent commission, what will be

the total commission paid at the end of the term?

a. | $7,290 | c. | $7,429 | b. | $7,087 | d. | $7,920 |

|

|

|

74.

|

The lease agreement for Julia's Fine Arts store was as follows: $1,200

fixed monthly

rent plus 4 percent commission on all sales over $850,000. This year, her gross

sales were $1,500,000. How much was paid in rent?

a. | $14,400 | c. | $40,400 | b. | $26,000 | d. | $35,000 |

|

|

|

75.

|

A tenant entered into a 20-year graduated lease. She will pay $500 per month for

the

first 5 years, and $575 per month for the next 15 years. The property manager is paid

6

percent of the total rent collected, and he has another five buildings with the same agreement.

How much will he be paid over the life of the leases?

a. | $40,050 | c. | $50,260 | b. | $48,060 | d. | $55,350 |

|

|

|

76.

|

The XYZ store leases space in the mall with the following agreement: $575

fixed

monthly rent, plus a 5.25 percent commission on all sales over $225,000. The gross sales

were $389,250 for the year. What was the total rent paid by XYZ?

a. | $15,523 | c. | $9,600 | b. | $8,623 | d. | $15,253 |

|

|

|

77.

|

The KLM store leases space in the mall with a percentage lease and agreed to

pay

$425 monthly fixed rent and 6 percent on all sales over $175,000. This year, the total rent

paid was $9,321. What were the gross sales?

a. | $184,849 | c. | $213,530 | b. | $213,350 | d. | $245,350 |

|

|

|

78.

|

VonTrapp Heirlooms' percentage lease reads as follows: The tenant agrees to

pay $800 per month fixed rent plus 4 percent on all sales over one million dollars. If the total rent

paid was $49,600, the gross sales were

a. | $1,000,000. | c. | $2,000,000. | b. | $1,500,000. | d. | $2,500,000, |

|

|

|

79.

|

A home is valued at $250,000 and is insured for 80 percent of its value. The

one-year insurance policy was purchased on January 12, 2008, at a cost of $550. The property was

sold, and the buyer assumed the owner's policy on December 23, 2009. How much will the owner be

credited at the closing?

a. | $522.50 | c. | $27.50 | b. | $432.70 | d. | $29.03 |

|

|

|

80.

|

The seller's net after

paying a 6 percent commission was $355,000. The approximate sale price of the property

was a. | $377,660. | c. | $376,300. | b. | $379,850. | d. | $381,720. |

|

|

|

81.

|

An agent who works for XYZ Realty in Illinois and referred a buyer to an agent,

who works for ABC Realty in Georgia. The referring agent is to receive 25 percent of the

buyer’s agent's commission when the transaction closes. The buyer purchased a $350,000

home, and the 7 percent commission was split as follows: listing broker, 2 percent; listing agent, 2

percent; selling broker, 1.5 percent; tiling agent, 1.5 percent. How much was the referring agent

paid?

a. | $24,500.00 | c. | $5,250.50 | b. | $7,000.00 | d. | $1,312.50 |

|

|

|

82.

|

An agent works for JKJ Realty in North Dakota, and she referred a buyer to

an

agent who works for ASD Realty in South Dakota. The referring agent's check was

for

$2,062.50, or 25 percent of the buyer agent's portion. The 7 percent commission was split

as follows: listing broker, 2 percent; listing agent, 2 percent; selling broker, 1.5 percent; selling

agent, 1.5 percent. What was the sale price of the property?

a. | $500,000 | c. | $600,000 | b. | $550,000 | d. | $650,000 |

|

|

|

83.

|

A property was listed for $450,000. A buyer's offer of 95 percent of the

list price was

accepted. He had a 20 percent down payment and secured a 30-year fixed rate

loan

at 6.75% interest. How much interest will he pay the first month of the loan?

a. | $1,923.75 | c. | $7,695.00 | b. | $3,847.50 | d. | $23,085.00 |

|

|

|

84.

|

An investment property had a net operating income of $75,230, expenses of

$4,900,

additional income of $2,500, and a cap rate of 8 percent. What is the effective gross

income?

a. | $77,730 | c. | $80,130 | b. | $79,500 | d. | $82,630 |

|

|

|

85.

|

A rectangular lot is 275 feet deep, and it contains 2/3 of an acre. What is the

length of the lot?

a. | 158.4' | c. | 290.04' | b. | 106.5' | d. | 105.6' |

|

|

|

86.

|

Four years ago, a buyer purchased a property for $148,000. For three years, it

appreciated 4 percent each year, but the fourth year it depreciated 4 percent. What was the

approximate value of the property at the end of the fourth year?

a. | $159,020 | c. | $159,820 | b. | $159,130 | d. | $159,900 |

|

|

|

87.

|

A first-time buyer paid $135,500 for her property. Taxes in her community are

assessed at 80 percent of the market value. If the tax rate is 700 mills per $100, how much will be

escrowed for taxes for her monthly PITI payment?

a. | $63.00 | c. | $75.60 | b. | $63.23 | d. | $75.88 |

|

|

|

88.

|

The owners pay $137.81 in monthly property taxes. If the tax rate is $3.50 per

$100 and the assessment rate is 35 percent, what is the value of the property?

a. | $153,998.69 | c. | $166,532.72 | b. | $143,997.45 | d. | $134,997.54 |

|

|

|

89.

|

An agent is managing a 15-unit apartment building and is paid 9 percent of the

gross

income. She leases five apartments for $500, five for $550, and five for $600. There is a 3

percent vacancy rate and an additional income of $450 per month. The monthly operating expenses are

$1,749, and the owner is generating an 8 percent return on the investment. What is the effective

gross income on the building?

a. | $99,000 | c. | $80,442 | b. | $96,030 | d. | $101,430 |

|

|

|

90.

|

Four units are renting for $450 each per month. There is a 5 percent vacancy

factor,

and annual expenses are $3,547. The owner wants an 8 percent return on her investment, and

the property has an additional monthly income of $464. What is the effective gross income of the

property?

a. | $21,796 | c. | $20,984 | b. | $21,976 | d. | $26,088 |

|

|

|

91.

|

The buyers secured a loan with a 75 percent loan-to-value ratio. The interest

rate was

7.125 percent, and the term was for 30 years. The first month's interest payment

was

$477.82. What was the appraised value of the property?

a. | $107,300 | c. | $103,700 | b. | $80,475 | d. | $79,239 |

|

|

|

92.

|

An owner wants to receive a net of $82,000 after selling her home. She has an

existing

mortgage of $32,500 and will have selling expenses of $444. If the broker is to receive a

7 percent commission, what is the LOWEST offer that she can accept for the property?

a. | $122,990.08 | c. | $123,595.70 | b. | $122,515.08 | d. | $123,959.70 |

|

|

|

93.

|

A homeowner has a property valued at $125,000 that is assessed at 35 percent

of

its value. If the local tax rate is 6,400 mills per $100 of the assessed value, what are the

monthly taxes?

a. | $280.00 | c. | $480.00 | b. | $140.33 | d. | $233.33 |

|

|

|

94.

|

An offer was made for 90 percent of the $120,900 list price of a property. The

offer

was accepted, and the lender agreed to negotiate an 80 percent loan at 8 percent interest

for 30 years. The buyer had a $5,000 earnest money deposit, paid $350 for title expenses, $250 for

attorney fees, and had other expenses of $749. How much money does the buyer need to close on the

property?

a. | $18,111 | c. | $10,159 | b. | $23,111 | d. | $15,159 |

|

|

|

95.

|

A homeowner sold his property for $99,500. He paid a real estate commission of 6

percent, paid an attorney $250, paid a transfer tax of $99.50, paid his existing mortgage

of

$50,140, and agreed to a purchase-money mortgage of $10,000. What were his net proceeds at the

closing?

a. | $43,050.40 | c. | $53,040.50 | b. | $33,040.50 | d. | $33,050.40 |

|

|

|

96.

|

An owner of a four-plex has one unit that rents for $450 a month, one unit that

rents for $475 per month, and two units that rent for $500 per month. The vacancy rate is 4 percent,

and the monthly expenses average $350. If the rate of return on the property is 10 percent, what is

the value?

a. | $218,260 | c. | $189,760 | b. | $118,260 | d. | $179,760 |

|

|

|

97.

|

A house is now worth $105,000. The lot is now worth $50,000. If the house

depreciated 4 percent each year for the past two years, and the lot appreciated 6 percent each year

for the past two years, what was the approximate combined original value of the house and lot?

a. | $156,544 | c. | $109,375 | b. | $113,932 | d. | $170,112 |

|

|

|

98.

|

A borrower negotiated a loan of $150,000 at 4.75% interest for 30 years. His

monthly P&I payment was $782.47. After making his payment on December 1, his principal balance

was $144,212.71. The note contained a prepayment penalty of 2 percent. After making his payment on

January 1, the borrower paid off the remaining mortgage balance. How much was he charged for the

prepayment penalty?

a. | $2,875.77 | c. | $2,884.25 | b. | $2,880.02 | d. | $2,925.34 |

|

|

|

99.

|

A buyer assumed the seller's insurance policy on June 24, 2009. The owner

paid $649.50 for a three-year policy on April 30, 2008. Which of the following is TRUE? (Use a

360-day year.)

a. | $249.90 DS, CB | c. | $399.00 CS, DB | b. | $249.90 CB, DS | d. | $399.00 DB, CS |

|

|

|

100.

|

On September 20, 2008, a buyer closed on her new $160,000 home, and she insured

80 percent of its value. Her premium on the two-year policy was $3.75 per $1,000. On November 11,

2009, she sold the property, and the buyer assumed the policy. Using a 360-day year, how much will

the buyer be debited at the closing?

a. | $480.00 | c. | $205.34 | b. | $273.99 | d. | $274.01 |

|